Download Copyright Form Pajak 1721 Excel

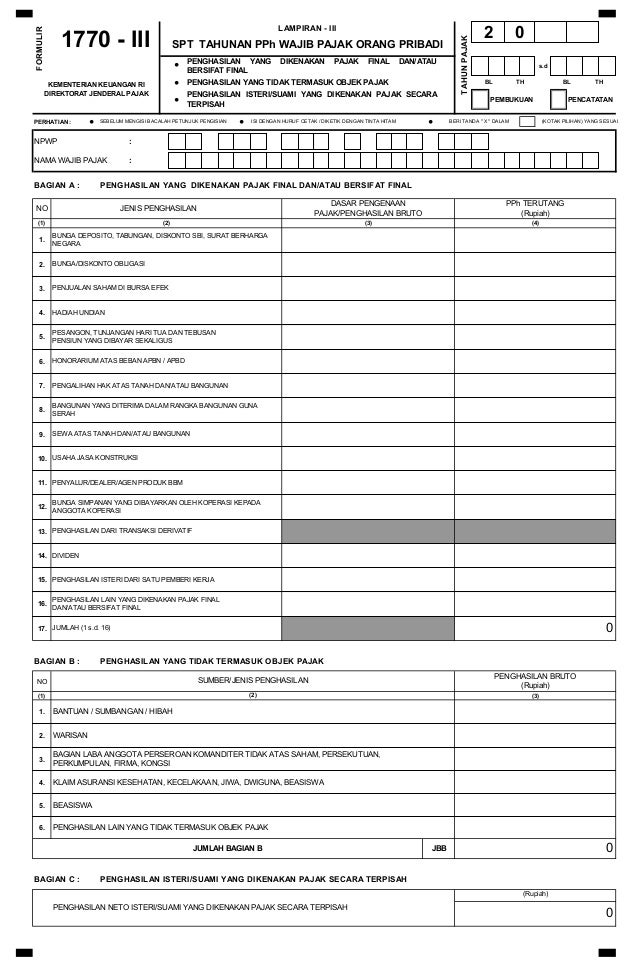

Spt tahunan pph wajib pajak orang pribadi formulir 1770 • 1. GENERAL INSTRUCTIONS FOR THE COMPLETION SPT 1770 DIGITAL FORM 1. This form is in compliance with the regulations the Director General of Taxes Number PER- 34/PJ/2010 about Income Tax Annual Return Form and General Instructions as amended by regulation the Director General of Taxes Number PER-19/PJ/2014.

10 mg paxil effective 'In the U.S., gasoline has fallen of late and should positively impact household wealth, which in turn should support future retail sales, promoting upside in GDP.' Blank putevogo lista na uchebnij avtomobilj.

Copyright SAP AG 2014. Page 2 of 17. In order to use the 'PDF' technology to print form 1721-A1, you should do some basic. Within one tax year, once employee's sequence is reported by e-SPT, then it cannot be. You can download the latest version of the e-SPT application from the official DGT website.

This form is used for completion income tax annual tax return for Taxable Year 2014 and onwards; 2. This form is printed with a scale of 98% (not printed in mode 'fit size' or 'shrink size'. This printing results must be signed and must not be folded or crumpled. Use HVS paper size: a. F4/Folio/US Folio/Government Legal (8,5 X 13 inch); b. Minimum weight 70 gr; 3. To be able to use this form optimally, use the application Adobe Reader version 8 or newer; 4.

Complete the Taxable Year, the identity of the Taxpayer and the other mandatory information properly (red box ). Taxpayers can contact the tax office where the Taxpayer is registered to ensure their Taxpayer Indentity Number (TIN) or through applications on the site www.pajak.go.id. Description of status of married individual are as follows: a. KK: Tax rights and obligations undertaken by the head of the family; b. HB: Spouse have lived separated based on a court decision; c. PH: It is requested in writing by both the husband and wife on the basis of an agreement for the separation of property and income; and d. MT: It is requested by the wife who chooses to meet her tax right and obligation separately.

Complete the attachments form first (green box ). Summation formulas, reduction, connection with certain parts and others have been available in this form, so that Taxpayers do not need to do a recount (blue box and brown box ); 6. Blue boxes and brown boxes shows the results of automatic calculation. There are times when automatic calculation is too late to execute. Taxpayer is expected to keep doing re-checking the results of calculations on this tax return, especially in the blue boxes dan brown boxes; 7. After all attachments completed, complete the main form on the yellow boxes. In case the taxpayer status is PH or MT, the Personal Exemption and Taxable Income will automatically filled the symbol 0.

Next, Taxpayer complete Calculation Income Tax Payable for Taxpayers with status PH or MT in the pink boxes; 9. In case the taxpayer status is KK or HB, the Personal Exemption filled by the taxpayer in accordance with the provisions; 10. Completion the main form continued in purple boxes until finished; 11. The SHOW button used to show calculation formulas in completing digital tax return; 12. The RESET button used to clear the data of digital tax return form that have been loaded previously. After completing the tax return and print it, do not forget to save it to another file (Save-as and name different from the original file), then use the RESET button to clear the file; 13. The HIDE button used to hide the calculation formula so that it can be printed blank form if you want to complete it manually; 14.